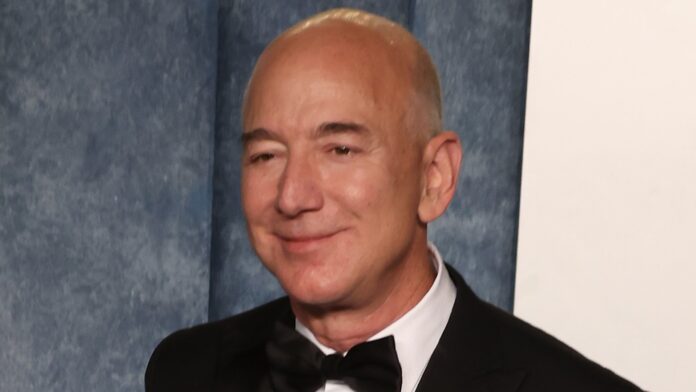

Jeff Bezos, now one of the world’s richest individuals with a net worth of approximately $243 billion, didn’t achieve billionaire status until his mid-30s. This reality challenges the common misconception that wealth accumulation requires a young start. His story demonstrates that significant financial success can be achieved later in life, proving that age is not a limiting factor.

The Delayed Breakthrough

Bezos founded Amazon in 1994, operating out of a garage with a small team. However, he didn’t become a billionaire until 1999, at the age of 35. The company’s early growth was rapid: sales reached $20,000 per week within two months, and Amazon went public in 1997. By 2024, yearly sales had surged to $634 billion. This trajectory underscores that delayed success does not equate to being behind. Bezos expanded his ventures beyond Amazon, founding Blue Origin and acquiring The Washington Post, further solidifying his financial empire.

The Power of Long-Term Vision

Amazon’s success isn’t solely due to luck. A core value is long-term thinking; the company is willing to invest in projects that may not yield immediate returns. Amazon Prime Video, for instance, was the result of a decade of research, development, and content acquisition. Many companies abandon ideas if they don’t produce quick profits, but Amazon persists, learning and improving until momentum builds. This patient approach is critical for sustainable growth.

Prioritizing Growth Over Immediate Profit

Bezos’ commitment to reinvestment played a crucial role in Amazon’s expansion. Despite being the executive chairman and major shareholder, Bezos’ salary from Amazon in 2020 was just $81,840 – a middle-income wage in California. The company focused on “plowing revenue back into growth,” prioritizing expansion over immediate profitability. This strategy allowed Amazon to scale rapidly, even if it meant operating at minimal or negative profit margins initially. Sacrificing short-term gains for long-term dominance is a hallmark of Bezos’ approach.

Embracing Risk and Failure

Bezos’ willingness to take risks was also vital to his success. He left a stable, high-paying finance job to start Amazon, making early-stage investments that could have easily failed. This willingness to embrace failure as a learning opportunity is essential for innovation and growth. Calculated risk-taking is not recklessness, but a necessary component of building wealth.

Bezos’ story serves as a reminder that financial success isn’t restricted by age. Commitment, long-term vision, reinvestment, and calculated risk-taking are key ingredients, regardless of when someone starts.

The implication is clear: starting later doesn’t mean being at a disadvantage, it simply means a different path. Bezos’ late rise to wealth is a testament to the idea that discipline, vision, and a willingness to take risks can overcome age-related barriers.